The 9.6% return for US equities in July exceeded all other major equity regions

While July saw a rally in most equity market regions (with the notable exception of China), the notable performance was delivered by US equities which outperformed the World ex US index by 5.8%.

Chart 1: Comparing regional equity returns in July (USD, TR, %)

Source: Refinitiv, FactSet

Looking at 10-year annualized returns US equities have delivered 13%, more than twice the 5.9% return from the World ex US.

Chart 2: Regional 10-year aggregate and annualized returns (USD, TR, %)

Source: Refinitiv, FactSet

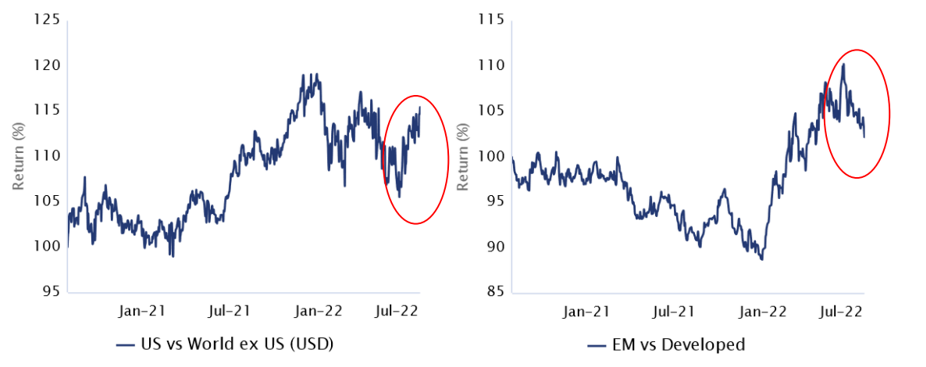

The rally in the US relative performance in July saw it rebound back to levels seen earlier this year. By contrast, Emerging Market relative performance weakened

Chart 3: Relative performance charts for the US and Emerging Markets

Source: Refinitiv, FactSet

To identify the driver of US equity outperformance in July, it is useful to utilize sector weighted performance contribution analysis. Exhibit 4 compares the sector weighted contributions for the US and the World ex US indexes. The majority of the almost 6% outperformance of US equities in July was almost entirely due to the scale of contributions from the Technology and Consumer Discretionary sectors.

Chart 4: Sector weighted performance contributions US and World ex US for July

Source: Refinitiv, FactSet

Index 15303321 E0922

Wilshire has been applying highly tested theories and approaches to our client solutions since 1981.

You can count on our team of experts to help improve investment outcomes for a better future.