The 9.6% return for US equities in July exceeded all other major equity regions

While July saw a rally in most equity market regions (with the notable exception of China), the notable performance was delivered by US equities which outperformed the World ex US index by 5.8%.

Chart 1: Comparing regional equity returns in July (USD, TR, %)

Source: Refinitiv, FactSet

Looking at 10-year annualized returns US equities have delivered 13%, more than twice the 5.9% return from the World ex US.

Chart 2: Regional 10-year aggregate and annualized returns (USD, TR, %)

Source: Refinitiv, FactSet

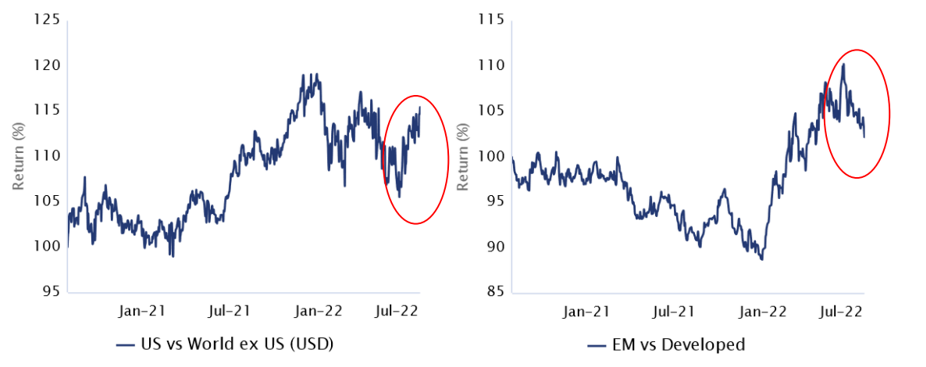

The rally in the US relative performance in July saw it rebound back to levels seen earlier this year. By contrast, Emerging Market relative performance weakened

Chart 3: Relative performance charts for the US and Emerging Markets

Source: Refinitiv, FactSet

To identify the driver of US equity outperformance in July, it is useful to utilize sector weighted performance contribution analysis. Exhibit 4 compares the sector weighted contributions for the US and the World ex US indexes. The majority of the almost 6% outperformance of US equities in July was almost entirely due to the scale of contributions from the Technology and Consumer Discretionary sectors.

Chart 4: Sector weighted performance contributions US and World ex US for July

Source: Refinitiv, FactSet

Index 15303321 E0922

The 9.6% return in July was driven by a rotation to growth stocks

July witnessed a strong recovery in the FT Wilshire 5000 index driven by a rally in growth stocks. Mounting concerns about recessionary headwinds boosted demand for long duration growth stocks by reducing discount rates (via lower nominal and real yields) and by increasing demand for their defensive attributes. The 9.6% rally in the FT Wilshire 5000 was the fifth largest monthly return in the last 20 years.

Chart 1: The fifth largest monthly return over the last 20 years

Source: Wilshire

Chart 2: Large-cap growth relative performance has responded to declining real yields

Source: Wilshire, FactSet

Sector weighted performance contributions take account of both the performance and respective sector weightings. Comparing the sector weighted contributions for large-cap growth and large cap value in July, it can be seen that the majority of growth's 6.4% outperformance relative to value was due to the size of the respective contributions from the key growth sectors - Technology, Consumer Goods and Services and Digital Information.

Chart 3: The sector weighted contributions to July performance

Source: Wilshire

Index 15303321 E0922

The first half of 2022 witnessed a significant correction to the FT Wilshire 5000 index taking the index back to levels last seen in early 2021

A key feature of the sell off was the rotation out of long duration growth and tech stocks in response to rising real yields. It also produced a statistically significant decline in PE valuation.

As at the close on June 30th 2022 the FT Wilshire 5000 index delivered a negative return of -20.9% for the first half of the year. Most of the negative return was delivered by the substantial Q2 correction of -16.8% as market sentiment reacted to mounting stagflation angst and increasingly hawkish Federal Reserve guidance.

Chart 1: The largest half year correction on record

Source: Wilshire, Refinitiv

Chart 2: The correction has rewound the index back to February 2021 levels:

Source: Wilshire, Refinitiv, FactSet

However, despite the pullback US equities have still delivered strong nominal and real long-term returns measured on both an aggregate and annualized basis.

Chart 3: Strong long term Nominal and Real returns

Source: Wilshire, Refinitiv, FactSet

A significant element of the correction was driven by a rotation out of long duration growth and technology stocks as real yields increased

Chart 4: Rising Real Yields have led to Growth stock underperformance/Value stock performance

Source: Wilshire, Refinitiv, FactSet

The growth stock underperformance was dominated by the negative sector weighted performance contribution delivered by the Digital Information, Technology and Consumer Goods and Services sectors. Only the Energy sector posted a positive return contribution YTD.

Chart 5: FT Wilshire 500 Sector Weighted Performance Contributions YTD

Source: Wilshire

The correction has produced a significant and rapid PE decline - producing a rarely seen 3 standard deviation move.

Chart 6: A rapid and large decline in the PE valuation

Source: Refinitiv, FactSet

2022 has witnessed a large rotation in both factor and style indices

Low beta and Value were the best performing factors with momentum lagging. The "Pure" quality factor also outperformed reflecting increased risk aversion. The 16% outperformance of the Value style relative to Growth was a notable feature of the first half of the year.

The first half of 2022 produced large rotation in factors utilizing the FT Wilshire "Pure" factor methodology and data. In terms of relative performance, the Low Beta and Value Factors outperformed the most (responding to rising real yields) with the momentum factor underperforming significantly.

Interestingly the "Pure" Quality factor outperformed as well (unlike most other Quality Factor indices) - this reflects the Pure Factor methodology stripping away unintended sector and factor exposures. The outperformance of the quality factor reflected the desire to seek protection against recessionary headwinds.

Chart 1: Pure factor relative performance YTD

Source: Wilshire

Value has persistently outperformed while quality outperformed strongly in Q2. By contrast Momentum declined significantly in Q2 .

Chart 2: Relative return of Pure Factors YTD

Source: Wilshire

In terms of the size indices large and small delivered similar returns YTD with Micro cap slightly underperforming. The scale of the Value style outperformance was the key feature in the first half of 2022.

Chart 3: FT Wilshire 5000 size and style returns

Source: Wilshire

A notable feature of 2022 market dynamics has been the 16% outperformance of Value relative to Growth. The Growth /Value relative return ratio appears to be returning to pre-Covid levels

Chart 4: Growth Style Index returns relative to Value

Source: Wilshire

Index 15303321 E0922

Wilshire has been applying highly tested theories and approaches to our client solutions since 1981.

You can count on our team of experts to help improve investment outcomes for a better future.