The scale of decline in valuations was one of the largest de-ratings witnessed in 30 years

As can be seen in Chart 1 the US and UK markets witnessed the largest proportionate decline in their PE levels comparing mid - year valuations with those as at year end 2021.The US PE valuation has fallen -26.8% from 22.5x to 16.4x over a six-month period.

Chart 1: Regional 12M PE ratios - now v levels at the end of 2021

Measuring the six month change in the market PE and comparing this to historical moves we can see in Chart 2 that the recent decline US has experienced a statistically significant (3 standard deviation) valuation correction. This is one of the largest moves over the last 30 years.

Chart 2: Measuring the 6-month change in the US 12M PE

Chart 3 below decomposes market return drivers into three categories - the contribution of changes to EPS forecasts, Dividends and Valuations. YTD data as at end June 2022 clearly shows the scale of performance drag delivered by the decline in PE valuations

Chart 3: YTD regional market return decomposition

A function of the US market experiencing a proportionately large PE de-rating is that it has seen its PE relative premium (comparing the PE of the US market to that of the World ex US market) decline from a peak of 55% in March this year to a current level of 32%.

By contrast the PE relative for Emerging Markets has moved from a c. 20% discount to parity - something last seen in 2016.

Chart 4: PE relatives comparisons

Index 15303321 E0922

Important Information

Wilshire is a global financial services firm providing diverse services to various types of investors and intermediaries. Wilshire’s products, services, investment approach and advice may differ between clients and all of Wilshire’s products and services may not be available to all clients. For more information regarding Wilshire’s services, please see Wilshire’s ADV Part 2 available at www.wilshire.com/ADV.

This material is intended for informational purposes only and should not be construed as legal, accounting, tax, investment, or other professional advice.

This material contains proprietary information of Wilshire. It may not be disclosed, reproduced, or otherwise distributed, in whole or in part, to any other person or entity without prior written permission from Wilshire.

This material represents the current opinion of Wilshire and is subject to change without notice. Wilshire assumes no duty to update any such opinions. Wilshire believes that the information obtained from third party sources contained herein is reliable, but has not undertaken to verify such information. Wilshire gives no representations or warranties as to the accuracy of such information, and accepts no responsibility or liability (including for indirect, consequential or incidental damages) for any error,omission or inaccuracy in such information and for results obtained from its use.

This material may include estimates, projections, assumptions and other "forward-looking statements". Forward-looking statements represent Wilshire's current beliefs and opinions in respect of potentialfuture events. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual events, performance and financial results to differ materially from any projections. Forward-looking statements speak only as of the date on which they are made and are subject to change without notice. Wilshire undertakes no obligation to update or revise any forward-looking statements.

Wilshire Advisors LLC (Wilshire) is an investment advisor registered with the SEC. Wilshire® is a registered service mark. All other trade names, trademarks, and/or service marks are the property of their respective holders.

Copyright © 2022 Wilshire. All rights reserved.

While July saw a rally in most equity market regions (with the notable exception of China), the notable performance was delivered by US equities which outperformed the World ex US index by 5.8%.

Chart 1: Comparing regional equity returns in July (USD, TR, %)

Source: Refinitiv, FactSet

Looking at 10-year annualized returns US equities have delivered 13%, more than twice the 5.9% return from the World ex US.

Chart 2: Regional 10-year aggregate and annualized returns (USD, TR, %)

Source: Refinitiv, FactSet

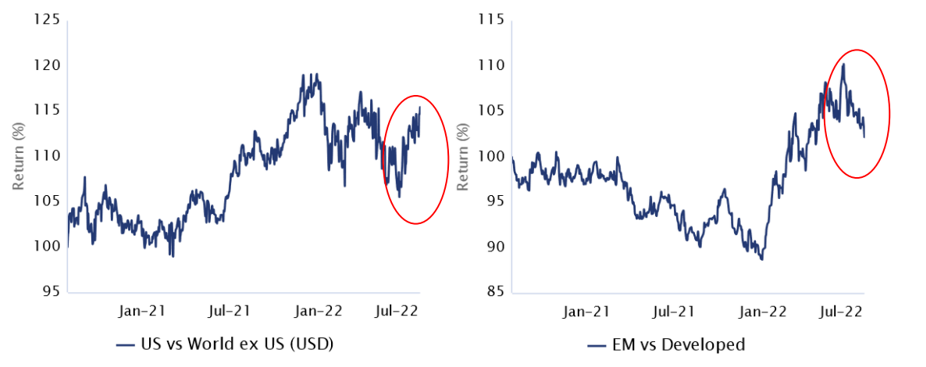

The rally in the US relative performance in July saw it rebound back to levels seen earlier this year. By contrast, Emerging Market relative performance weakened

Chart 3: Relative performance charts for the US and Emerging Markets

Source: Refinitiv, FactSet

To identify the driver of US equity outperformance in July, it is useful to utilize sector weighted performance contribution analysis. Exhibit 4 compares the sector weighted contributions for the US and the World ex US indexes. The majority of the almost 6% outperformance of US equities in July was almost entirely due to the scale of contributions from the Technology and Consumer Discretionary sectors.

Chart 4: Sector weighted performance contributions US and World ex US for July

Source: Refinitiv, FactSet

Index 15303321 E0922

Low beta and Value were the best performing factors with momentum lagging. The "Pure" quality factor also outperformed reflecting increased risk aversion. The 16% outperformance of the Value style relative to Growth was a notable feature of the first half of the year.

The first half of 2022 produced large rotation in factors utilizing the FT Wilshire "Pure" factor methodology and data. In terms of relative performance, the Low Beta and Value Factors outperformed the most (responding to rising real yields) with the momentum factor underperforming significantly.

Interestingly the "Pure" Quality factor outperformed as well (unlike most other Quality Factor indices) - this reflects the Pure Factor methodology stripping away unintended sector and factor exposures. The outperformance of the quality factor reflected the desire to seek protection against recessionary headwinds.

Chart 1: Pure factor relative performance YTD

Source: Wilshire

Value has persistently outperformed while quality outperformed strongly in Q2. By contrast Momentum declined significantly in Q2 .

Chart 2: Relative return of Pure Factors YTD

Source: Wilshire

In terms of the size indices large and small delivered similar returns YTD with Micro cap slightly underperforming. The scale of the Value style outperformance was the key feature in the first half of 2022.

Chart 3: FT Wilshire 5000 size and style returns

Source: Wilshire

A notable feature of 2022 market dynamics has been the 16% outperformance of Value relative to Growth. The Growth /Value relative return ratio appears to be returning to pre-Covid levels

Chart 4: Growth Style Index returns relative to Value

Source: Wilshire

Index 15303321 E0922

A key feature of the sell off was the rotation out of long duration growth and tech stocks in response to rising real yields. It also produced a statistically significant decline in PE valuation.

As at the close on June 30th 2022 the FT Wilshire 5000 index delivered a negative return of -20.9% for the first half of the year. Most of the negative return was delivered by the substantial Q2 correction of -16.8% as market sentiment reacted to mounting stagflation angst and increasingly hawkish Federal Reserve guidance.

Chart 1: The largest half year correction on record

Source: Wilshire, Refinitiv

Chart 2: The correction has rewound the index back to February 2021 levels:

Source: Wilshire, Refinitiv, FactSet

However, despite the pullback US equities have still delivered strong nominal and real long-term returns measured on both an aggregate and annualized basis.

Chart 3: Strong long term Nominal and Real returns

Source: Wilshire, Refinitiv, FactSet

A significant element of the correction was driven by a rotation out of long duration growth and technology stocks as real yields increased

Chart 4: Rising Real Yields have led to Growth stock underperformance/Value stock performance

Source: Wilshire, Refinitiv, FactSet

The growth stock underperformance was dominated by the negative sector weighted performance contribution delivered by the Digital Information, Technology and Consumer Goods and Services sectors. Only the Energy sector posted a positive return contribution YTD.

Chart 5: FT Wilshire 500 Sector Weighted Performance Contributions YTD

Source: Wilshire

The correction has produced a significant and rapid PE decline - producing a rarely seen 3 standard deviation move.

Chart 6: A rapid and large decline in the PE valuation

Source: Refinitiv, FactSet

Wilshire has been applying highly tested theories and approaches to our client solutions since 1981.

You can count on our team of experts to help improve investment outcomes for a better future.